Silver prices edged higher to $37.90 in Tuesday’s Asian session, gaining 0.73% on the day. As expectations grow for a U.S. Federal Reserve rate cut, the precious metal is finding support, but optimism in global financial markets may limit its upside potential, keeping silver within a well-defined range.

📈 Silver Price Gains Amid Fed Rate Cut Bets

XAG/USD attracted buying interest near $37.90, as rising Fed rate cut bets continued to provide a tailwind for silver. With soft U.S. jobs data for July reinforcing expectations that the Federal Reserve could pivot toward accommodative policies soon, the white metal is benefiting from a weaker U.S. Dollar (USD).

Fed rate cut expectations are now soaring, with 90% probability priced in for a September rate cut, while markets are also pricing in 58 basis points (bps) of reductions by year-end, including a possible third cut.

- Lower interest rates typically reduce the opportunity cost of holding non-yielding assets like silver, further supporting the demand for the metal.

🧐 Market Sentiment Shifts Amid Optimism

However, market sentiment has shifted towards optimism, capping the appeal of safe-haven assets like silver. On Monday, U.S. President Donald Trump announced a 90-day delay on tariffs with China, easing tensions between the world’s two largest economies just hours before the previous agreement was set to expire.

While this positive news supports broader risk assets, it has slightly undermined the demand for silver as a defensive investment.

🔍 What’s Next for Silver?

Traders will focus on U.S. CPI data later this Tuesday, which will provide further insights into inflation and influence Fed policy expectations. A soft inflation print could trigger more buying in silver, while a stronger-than-expected report might dampen the likelihood of aggressive rate cuts, limiting silver’s upside potential.

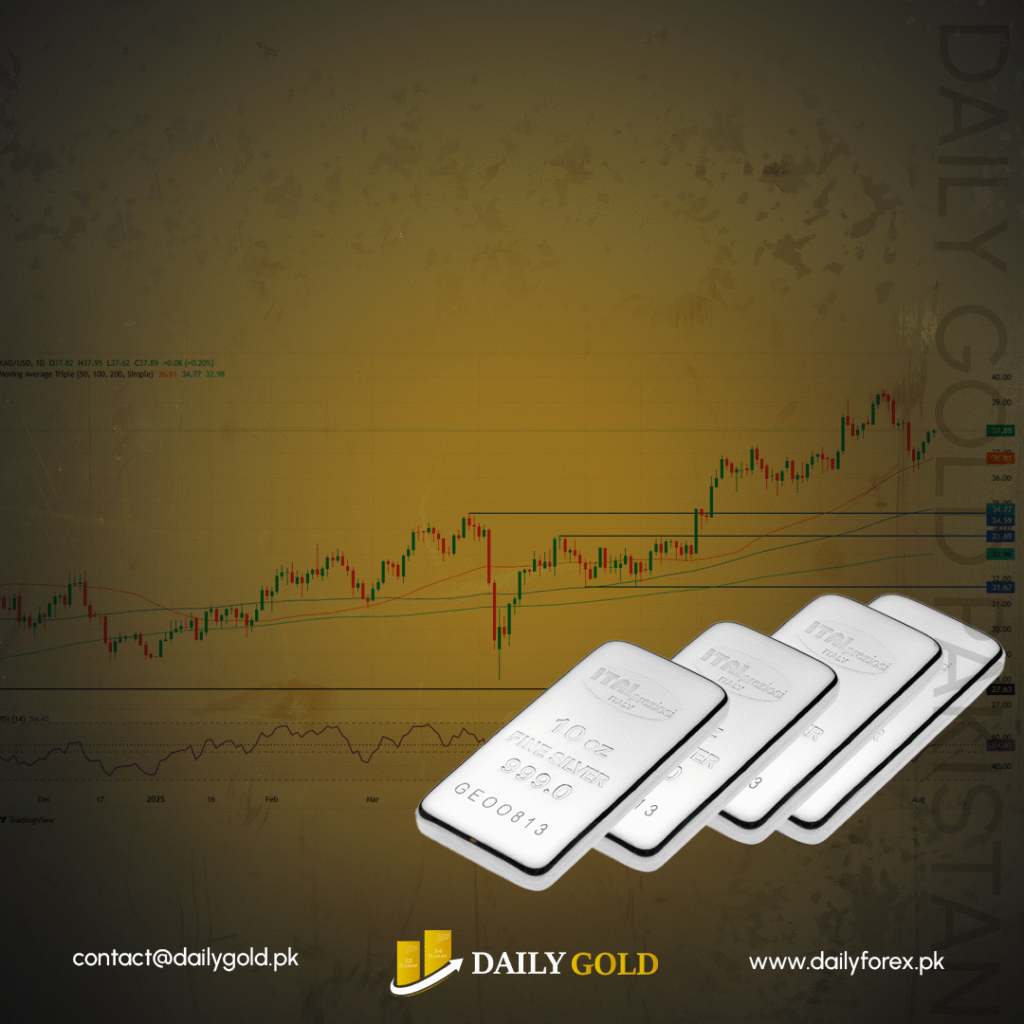

📊 Technical Outlook for Silver (XAG/USD)

- Key Support: $37.50

- Key Resistance: $38.00

- Target Area: $39.00 and above if bullish momentum sustains.

- A sustained move above $38.00 could open the path for further gains toward $39.00 and possibly even higher, depending on broader market conditions and inflation data.

📢 Stay updated with the latest silver price trends, market analysis, and forecasts at

👉 www.dailygold.pk