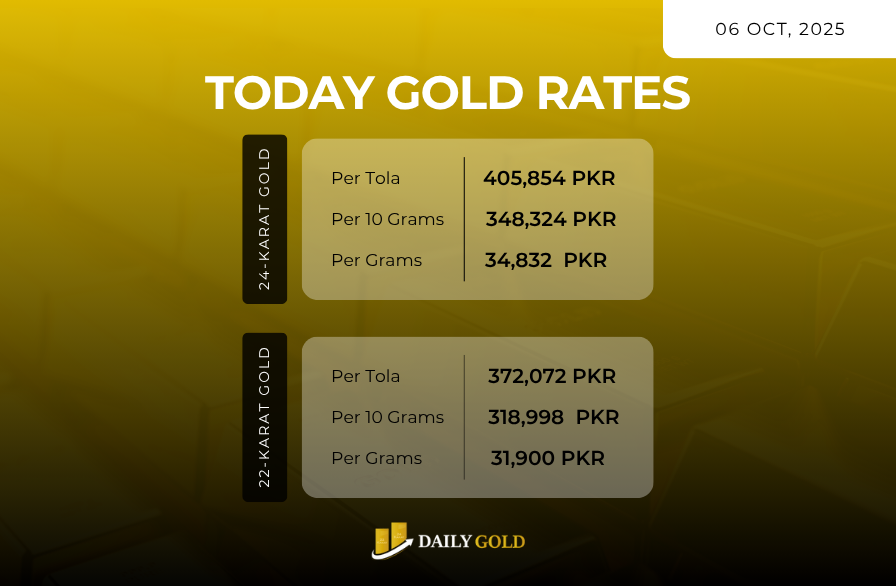

Gold in Pakistan appears to be holding firm at elevated levels today. Based on available sources, the 24K rate is roughly ₨ 405,854 per tola, with 10 grams priced near ₨ 348,324, and per gram around ₨ 34,832. The 22K variant is estimated at ₨ 372,072 per tola. These rates reflect sustained demand, backed by global and domestic factors.

| Purity | Per Tola (PKR) | Per 10 Grams (PKR) | Per Gram (PKR) |

|---|---|---|---|

| 24K Gold | ~ ₨ 405,854 | ~ ₨ 348,324 | ~ ₨ 34,832 |

| 22K Gold | ~ ₨ 372,072 | ~ ₨ 318,998 | ~ ₨ 31,900 |

On the international front, gold continues to benefit from safe‑haven flows and expectations that major central banks may shift toward more dovish policies amid slowing global growth. Inflation remains sticky in many economies, and risks of economic slowdowns or geopolitical uncertainty encourage flows into non‑yielding assets like gold.

Locally, gold is under pressure from multiple fronts: a weakening Pakistani rupee, rising import costs, and high inflation. These forces push up the local price even when global spot prices are relatively stable. Additionally, strong demand for gold jewelry (especially 22K) keeps physical buying robust in the domestic market. Fusion of investor, consumer, and speculation demand is maintaining tight price action.

From a technical standpoint, gold seems to be navigating resistance zones around its current level. Support may exist slightly below in the ₨ 390,000–400,000 per tola region. If upward momentum continues, gold could press toward ₨ 420,000+, but risks include a dollar rebound or hawkish signals from central banks.

Short‑term outlook for gold: Expect a range‑bound movement between ₨ 400,000 and 420,000 per tola, with possible upward moves if macro indicators (inflation, interest rate policy) tilt favorably.

Stay Updated with Daily Gold Pakistan.