Gold in Pakistan maintains strong footing today, with 24K gold hovering around ₨ 397,300 per tola and 22K gold near ₨ 364,168 per tola. The continued strength reflects persistent investor demand, inflation hedging, and local currency pressures.

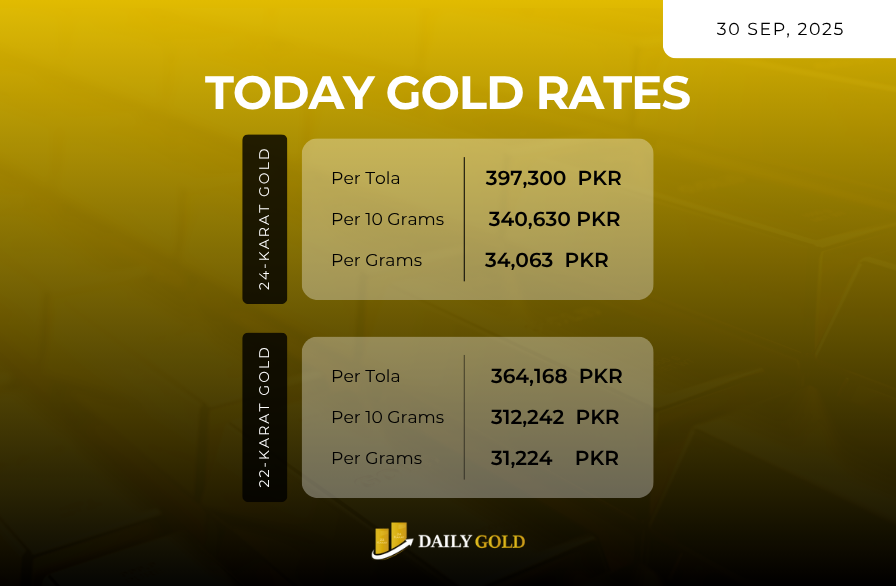

| Purity | Per Tola (PKR) | Per 10 Grams (PKR) | Per Gram (PKR) |

|---|---|---|---|

| 24K | ~ ₨ 397,300 | ~ ₨ 340,630 | ~ ₨ 34,063 |

| 22K | ~ ₨ 364,168 | ~ ₨ 312,242 | ~ ₨ 31,224 |

Globally, gold has climbed to record levels—spot prices moved past $3,800/oz as investors seek safe-haven assets amid growing economic uncertainty and expectations of further U.S. rate cuts. A weaker U.S. dollar amplifies gold’s appeal in non‑USD currencies, supporting higher local prices.

In Pakistan, multiple forces push gold upward:

- Rupee depreciation & import costs: As gold is largely imported, a weaker rupee inflates local prices.

- Inflation & real returns: With inflation eroding cash value, many investors park savings in gold.

- Jewellery & cultural demand: 22K remains especially in demand for weddings, gifting, and traditional uses, helping support its premium.

- Premiums & local markups: Dealers apply premiums and the supply chain’s margins add to the final cost.

Technically, gold seems to be testing resistance around its present levels. Support likely lies in the ₨ 380,000–390,000 per tola band. If sentiment and global cues remain favorable, gold could push past ₨ 400,000+. But any unexpected strength in the dollar or hawkish central bank actions could trigger a pullback or consolidation.

Short‑Term Outlook: Over the coming days, expect 24K gold to trade in a range between ₨ 390,000 and 405,000 per tola, assuming macro conditions remain supportive. 22K will likely follow a proportional path, adjusted for purity and local demand.

Stay Updated with Daily Gold Pakistan.