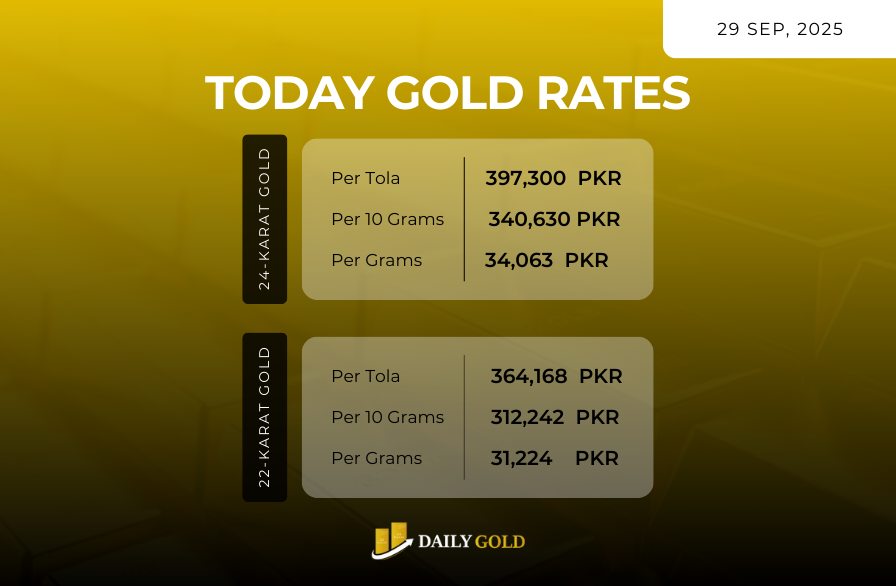

Gold price in Pakistan continues its strong performance, with the 24K rate at ₨ 397,300 per tola, while 22K trades at ₨ 364,168 per tola. The 10‑gram and per‑gram rates reflect the same uptick in value. These rates are drawn from the Karachi Sarafa markets and major city price compilations.

| Purity | Per Tola (PKR) | Per 10 Grams (PKR) | Per Gram (PKR) |

|---|---|---|---|

| 24K Gold | ₨ 397,300 | ₨ 340,630 | ₨ 34,063 |

| 22K Gold | ₨ 364,168 | ₨ 312,242 | ₨ 31,224 |

Globally, gold has broken new ground, passing $3,800 per ounce—a milestone fueled by soft U.S. dollar dynamics and growing confidence that the Federal Reserve may cut interest rates further later in the year. The weaker dollar reduces the cost of gold in currencies like the Pakistani rupee, which adds local upward pressure.

Within Pakistan, multiple tailwinds align in gold’s favor. The rupee remains under depreciation pressure, which pushes up import costs for bullion. Inflation continues to erode savings in cash, encouraging investors to shift toward tangible assets like gold. Jewelry demand is still strong, especially for 22K, given cultural and seasonal factors. Dealers report rising premiums in many cities, which are getting added to the base international pricing.

From a technical perspective, gold has moved into a resistance zone near current levels. Support is likely around ₨ 385,000 – ₨ 390,000 per tola, and a break above ₨ 400,000+ is possible if favorable macro cues arrive. That said, risks include a sudden rebound in the dollar or hawkish surprise from central banks.

Short‑Term Forecast: In the near term, 24K gold may fluctuate between ₨ 390,000 and 405,000 per tola depending on global data, FX moves, and local demand. 22K is expected to follow a similar pattern, possibly ranging between ₨ 355,000 and 370,000 per tola.

Stay Updated with Daily Gold Pakistan.