Gold prices in Pakistan have experienced a slight rise today, with 24K gold priced at Rs. 447,700 per tola, continuing the bullish trend from the previous days. The steady increase in gold prices is driven by global market movements, inflation concerns, and ongoing demand from the domestic market, especially due to seasonal purchases.

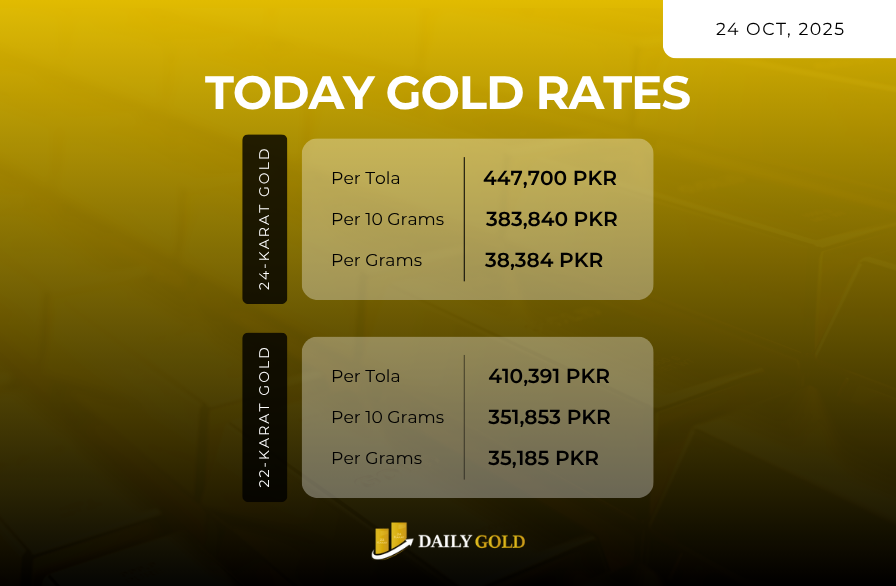

Today’s Gold Rates

| Gold Purity | Per Tola (PKR) | Per Gram (PKR) | Per 10 Grams (PKR) | Per Ounce (PKR) |

|---|---|---|---|---|

| 24K Gold | Rs. 447,700 | Rs. 38,384 | Rs. 383,840 | Rs. 1,087,911 |

| 22K Gold | Rs. 410,391.67 | Rs. 35,185.33 | Rs. 351,853.33 | Rs. 997,251.75 |

| 21K Gold | Rs. 391,737.5 | Rs. 33,586 | Rs. 335,860 | Rs. 951,922.13 |

| 18K Gold | Rs. 335,775 | Rs. 28,788 | Rs. 287,880 | Rs. 815,933.25 |

Gold Market Overview

Gold prices have continued to trend upward in Pakistan, supported by global inflation, currency fluctuations, and strong retail demand. The 24K gold rate stands at Rs. 447,700 per tola, reflecting an increase of approximately 2.5% over the past week. This rise comes amid continued inflationary pressures and geopolitical uncertainty, driving investors to gold as a safe-haven asset.

Local gold prices have been influenced by the depreciating Pakistani Rupee, which has increased the cost of imported gold. Domestic jewelry demand also remains strong due to the ongoing wedding season in Pakistan, further supporting prices.

Key Market Drivers Today:

- Global Inflation Concerns: Inflation continues to rise globally, especially in key markets like the U.S. and Europe, leading to an increased demand for gold as a hedge.

- Weakening U.S. Dollar: A weaker U.S. dollar is generally positive for gold, as it becomes more affordable for non-dollar holders.

- Geopolitical Tensions: Ongoing conflicts in Europe and the Middle East have led to more safe-haven buying in gold, further boosting demand.

- Seasonal Jewelry Demand: Pakistan’s wedding season is keeping retail gold demand high, especially in 22K and 18K gold.

Why is Gold Holding Strong?

Gold has always been a reliable asset during uncertain times. As inflation persists globally and financial markets remain volatile, investors have consistently turned to gold to preserve wealth. Furthermore, the lower bond yields and weak U.S. dollar have reinforced the bullish sentiment in gold, pushing its price higher.

Investment Insight:

Given the current market conditions, gold is expected to maintain its upward momentum in the short term. Experts suggest buying on dips, especially as gold continues to offer both security and long-term value preservation.

For retail investors, gradual accumulation of gold through monthly or weekly purchases is a prudent strategy, especially in times of price volatility.

Stay updated daily with real-time gold prices and market insights at:

🔗 www.dailygold.pk