Today’s gold prices in Pakistan reflect a mild dip from recent highs, as global bullion markets stabilized following strong economic data from the U.S. The 24-karat gold rate in Pakistan stands at Rs. 439,500 per tola, marking a modest correction compared to the previous session. Despite the short-term decline, long-term sentiment in the gold market remains positive as investors continue to hedge against inflation and currency depreciation.

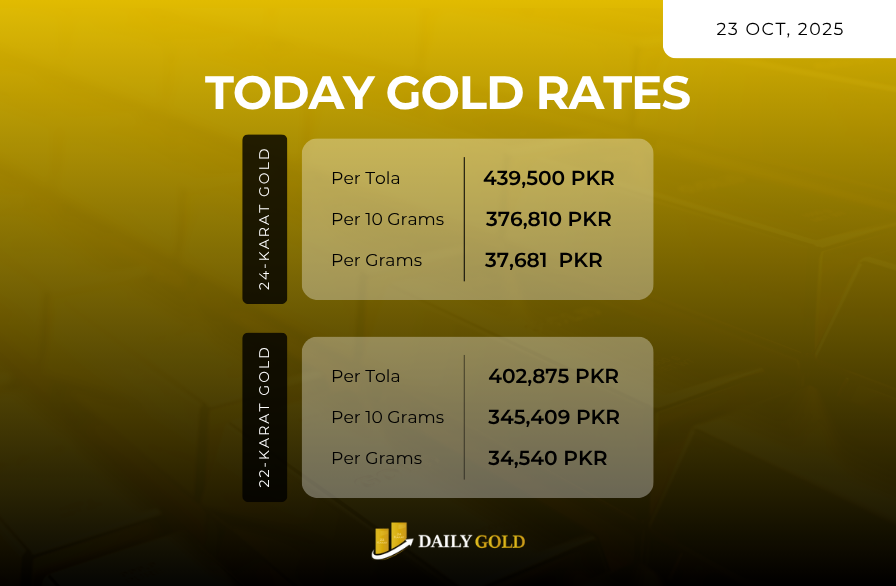

Today’s Gold Rates

| Gold Purity | Per Tola (PKR) | Per Gram (PKR) | Per 10 Grams (PKR) | Per Ounce (PKR) |

|---|---|---|---|---|

| 24K Gold | Rs. 439,500 | Rs. 37,681 | Rs. 376,810 | Rs. 1,067,985 |

| 22K Gold | Rs. 402,875 | Rs. 34,540.92 | Rs. 345,409.17 | Rs. 978,986.25 |

| 21K Gold | Rs. 384,562.5 | Rs. 32,970.88 | Rs. 329,708.75 | Rs. 934,486.88 |

| 18K Gold | Rs. 329,625 | Rs. 28,260.75 | Rs. 282,607.5 | Rs. 800,988.75 |

Market Overview

The domestic gold market witnessed a slight pullback today, aligning with the global correction seen in international spot prices. After weeks of steady gains, profit-taking by large investors and a stronger U.S. dollar index temporarily pressured bullion prices.

However, local dynamics in Pakistan continue to favor gold’s long-term uptrend. With the Pakistani Rupee under persistent pressure, and inflation hovering at multi-year highs, gold remains an essential asset for wealth preservation among investors and households.

The wedding season across Pakistan has further supported retail jewelry demand, particularly in major markets like Karachi, Lahore, and Islamabad. Jewelers report consistent buying activity, especially in 22K and 21K jewelry, which remain preferred for their balance of purity and durability.

Key Market Drivers

- Global Gold Prices – International gold remains near $2,360 per ounce, adjusting after a sharp rally earlier this week.

- Exchange Rate Effect – The rupee’s fluctuation against the U.S. dollar continues to impact local bullion rates.

- Inflation & Interest Rates – Persistent inflationary pressures keep gold attractive as a hedge despite temporary price corrections.

- Investor Demand – Retail investors are using price dips to accumulate physical gold.

Investment Insight

Although gold has seen a short-term price decline, the overall market outlook remains bullish. Analysts expect renewed upward movement once the global economic data stabilizes. The current price levels around Rs. 439,500 per tola offer an opportunity for strategic buyers to enter the market before another upward phase.

For long-term investors, staggered buying is recommended to average out fluctuations and safeguard capital from inflation and currency erosion.

Stay updated with daily gold and silver rates at:

🔗 www.dailygold.pk