As the new week kicks off, gold prices in Pakistan have shown slight adjustments, maintaining an overall stable tone compared to last week’s volatile moves. The local bullion market opened today with gold prices just marginally lower, reflecting moderate shifts in international rates and currency exchange trends.

With global uncertainties persisting, including ongoing geopolitical tensions and mixed signals from the US Federal Reserve regarding interest rates, investors in Pakistan remain cautiously optimistic. The domestic demand, especially from wedding season buyers and retail investors, continues to support prices in the local market.

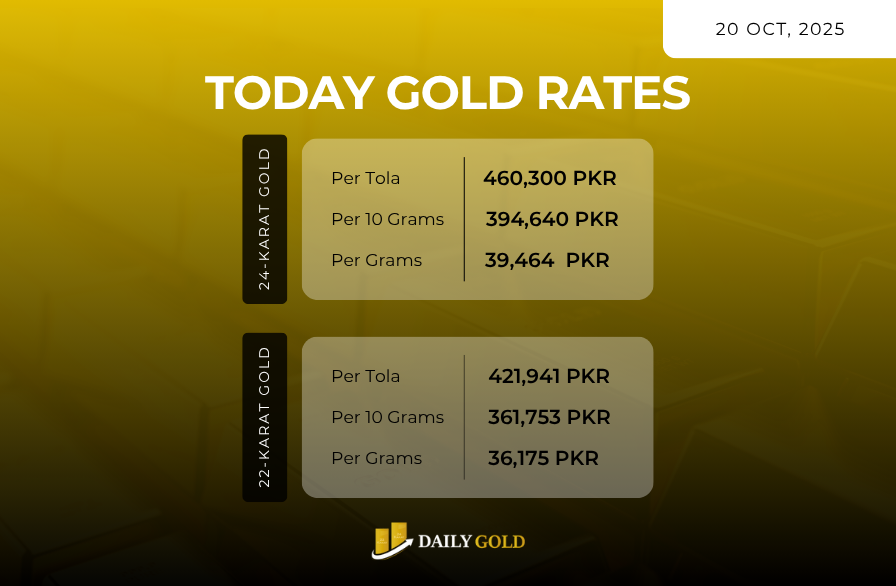

Let’s take a detailed look at the updated gold rates for today.

📊 Detailed Gold Price Table – 20 October 2025

| Gold Purity | Per Tola (PKR) | Per 10 Grams (PKR) | Per Gram (PKR) | Per Ounce (PKR) |

|---|---|---|---|---|

| 24K Gold | Rs. 460,300 | Rs. 394,640 | Rs. 39,464 | Rs. 1,118,529 |

| 22K Gold | Rs. 421,941.67 | Rs. 361,753.33 | Rs. 36,175.33 | Rs. 1,025,318.25 |

| 21K Gold | Rs. 402,762.5 | Rs. 345,310 | Rs. 34,531 | Rs. 978,712.88 |

| 18K Gold | Rs. 345,225 | Rs. 295,980 | Rs. 29,598 | Rs. 838,896.75 |

🌍 Market Insight & Factors Influencing Prices

Gold prices in Pakistan are largely driven by global spot rates, USD/PKR exchange fluctuations, and domestic demand. Today’s slight dip in 24K gold can be attributed to the following factors:

- USD Strength: The US Dollar gained slightly in international markets, putting mild pressure on global gold prices.

- Interest Rate Outlook: Uncertainty around the US Federal Reserve’s next move continues to affect bullion sentiment.

- Local Demand: Domestic demand remains strong due to wedding season and retail jewelry purchases, cushioning any major downturns.

The local price is also being shaped by the interbank USD/PKR rate, which plays a crucial role in adjusting the PKR-equivalent gold value.

🔮 Outlook for Coming Days

Analysts expect gold to remain range-bound in the short term, with potential upside if global uncertainties increase. Any sharp move in the USD/PKR rate or global inflation data could significantly impact local prices.

If you’re planning to buy gold for investment or jewelry, this could be a good time to monitor dips for entry opportunities. However, for short-term traders, caution is advised due to potential volatility from global economic data this week.

📢 Tip for Investors:

Diversify your portfolio. While gold remains a hedge against inflation, combining it with other safe-haven assets could help balance risk.

🔗 Stay Updated Daily:

Visit: www.dailygold.pk for latest gold and silver prices, forecasts, and precious metal news.