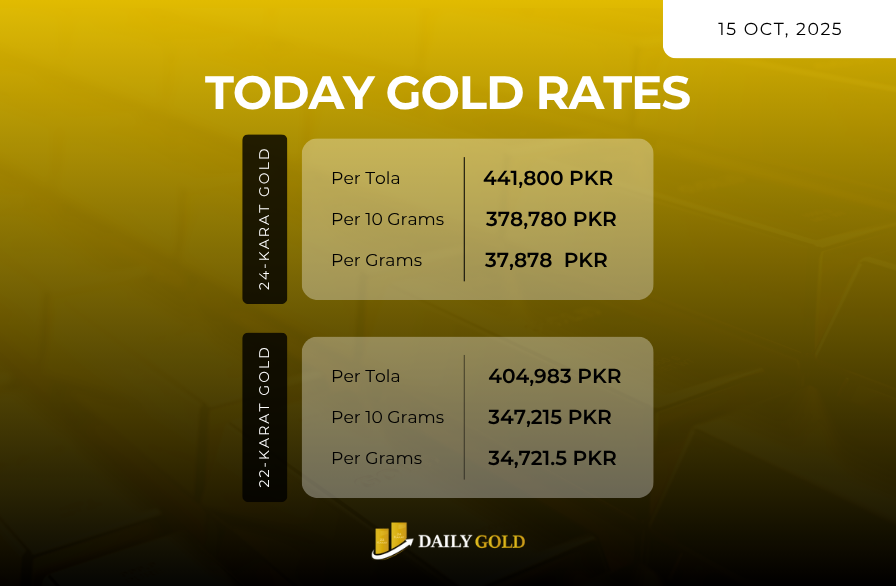

Gold prices in Pakistan have remained strong, with 24K gold now at ₨ 441,800 per tola. This price reflects a continuation of the upward trend that has been persistent throughout 2025, driven by both global and domestic factors. Meanwhile, 22K gold is priced at ₨ 404,983.33 per tola, and 21K gold is at ₨ 386,575 per tola.

| Purity | Per Tola (PKR) | Per 10 Grams (PKR) | Per Gram (PKR) | Per Ounce (PKR) |

|---|---|---|---|---|

| 24K Gold | ₨ 441,800 | ₨ 378,780 | ₨ 37,878 | ₨ 1,073,574 |

| 22K Gold | ₨ 404,983.33 | ₨ 347,215 | ₨ 34,721.5 | ₨ 984,109.50 |

| 21K Gold | ₨ 386,575 | ₨ 331,432.5 | ₨ 33,143.25 | ₨ 939,377.25 |

| 18K Gold | ₨ 331,350 | ₨ 284,085 | ₨ 28,408.5 | ₨ 805,180.50 |

Global Factors Supporting Gold Prices

- Inflation: Globally, inflation remains persistent, and gold continues to be a trusted hedge against the eroding value of fiat currencies. As central banks signal potential rate cuts, gold maintains its safe-haven status.

- Geopolitical Tensions: Escalating tensions in various parts of the world, particularly in Eastern Europe and the Middle East, continue to bolster gold demand. Investors seek safety in gold, pushing prices higher.

- Monetary Policy: With the Federal Reserve’s dovish stance, market expectations of rate cuts are driving demand for gold. Additionally, the continued weakening of the U.S. dollar against major currencies has made gold more appealing.

🇵🇰 Local Market Dynamics

In Pakistan, gold prices have surged due to a combination of global drivers and domestic pressures. The weakening rupee and rising inflation are key contributors, making gold a more attractive option for both investors and consumers. The wedding season is contributing to demand, especially for 22K gold, which remains the primary choice for traditional jewelry.

Jewelers are reporting an increase in demand despite the higher prices, particularly for 22K and 24K gold, as buyers continue to view it as a reliable store of value.

Technical Outlook for Gold

- Support: ₨ 430,000 – ₨ 435,000 per tola

- Resistance: ₨ 450,000 per tola

Gold is expected to maintain bullish momentum, testing new resistance at ₨ 450,000 per tola if global conditions remain supportive. A break above this level could open the door to ₨ 460,000.

Short-Term Forecast for Gold

Expect 24K gold to remain in the ₨ 435,000 to ₨ 450,000 per tola range. Potential surges beyond these levels will depend on global economic indicators and domestic buying pressure. If the U.S. dollar weakens further, or geopolitical risks heighten, gold could see significant price increases.