Gold prices in Pakistan have continued their upward trajectory, climbing to PKR 421,800 per tola for 24K gold—reflecting a strong recovery after last week’s brief consolidation phase. The increase from previous levels highlights both global and domestic factors driving bullish momentum in the gold market.

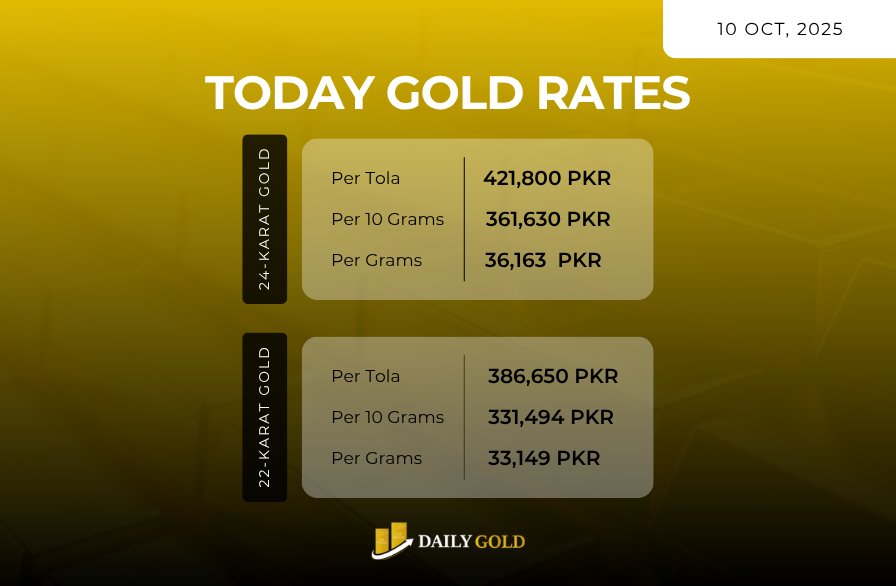

| Purity | Per Tola (PKR) | Per 10 Grams (PKR) | Per Gram (PKR) |

|---|---|---|---|

| 24K | 421,800 | 361,630 | 36,163 |

| 22K | 386,650 | 331,494.17 | 33,149.42 |

On the international front, gold is trading above $3,610/oz, fueled by renewed geopolitical tensions in Eastern Europe and uncertainty around the U.S. economic outlook. Analysts are closely watching the upcoming CPI data, which could further impact the Federal Reserve’s stance on interest rates. A potential rate cut would weaken the dollar, boosting gold prices further.

Locally, the devaluation of the Pakistani Rupee and persistent inflation are strengthening gold’s position as a safe-haven asset. As household purchasing power declines, investors are shifting from fiat to tangible assets—especially gold. The wedding season has also spurred increased demand for 22K jewelry, contributing to the higher pricing across major cities including Karachi, Lahore, and Islamabad.

Technically, gold has broken above the resistance level of PKR 421,800, and if momentum sustains. Support is now observed around PKR 421,800, providing a strong cushion for traders and investors in case of minor pullbacks.

Stay Updated with Daily Gold Pakistan.