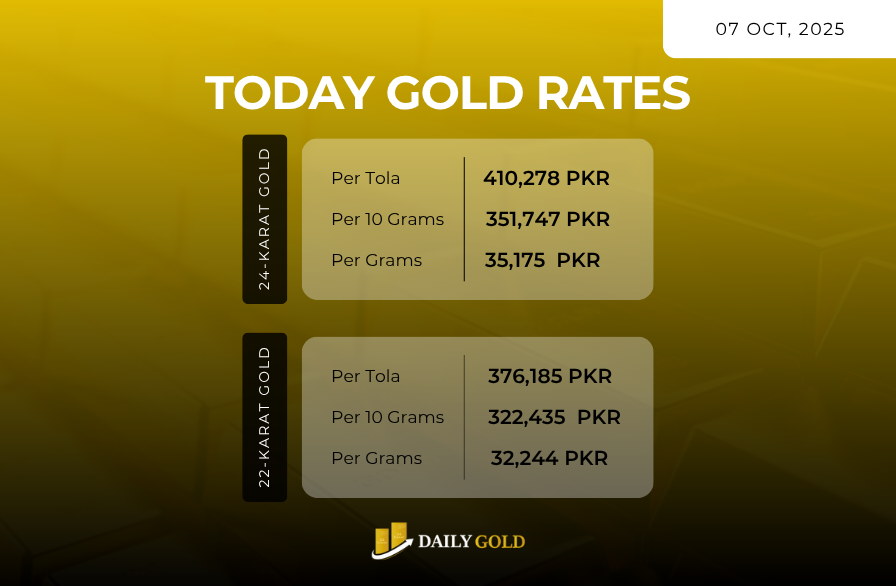

Gold prices in Pakistan remain elevated as the market consolidates gains from recent record highs. Today’s rate of Rs. 410,278 per tola for 24K gold marks another day of stability in the domestic bullion market, while 22K gold, popular for jewelry, is priced at Rs. 376,185 per tola.

| Purity | Per Tola (PKR) | Per 10 Grams (PKR) | Per Gram (PKR) |

|---|---|---|---|

| 24K | 410,278 | 351,747 | 35,175 |

| 22K | 376,185 | 322,435 | 32,244 |

Globally, gold continues to gain support from ongoing economic uncertainties and expectations of a potential shift in monetary policy by central banks. The U.S. Federal Reserve’s dovish tone has pushed global gold prices above $3,590/oz. Weaker job growth and higher inflation risks are steering investors toward safe-haven assets like gold.

Gold ETFs are witnessing renewed inflows, and central banks, particularly in emerging economies, are continuing their gold accumulation strategy. This global sentiment is pushing gold higher across regional markets, including Pakistan.

🇵🇰 Local Market Dynamics

In Pakistan, inflation remains stubbornly high, and the Pakistani Rupee continues to face pressure against the U.S. dollar. These factors have contributed to sustained domestic demand for gold. Additionally, the upcoming wedding season has increased foot traffic in local markets, especially for 22K jewelry items.

Retailers in Karachi, Lahore, and Faisalabad report strong demand despite high prices, suggesting that consumers are still seeing gold as a reliable store of value. Import restrictions and duties are adding further premiums to already elevated rates.

🔮 Forecast & Technical Insights

Support for gold remains firm around Rs. 405,000, with resistance now forming at Rs. 415,000 per tola. As long as prices remain above the Rs. 400,000 psychological level, the bullish outlook remains intact. Technically, the market shows consolidation with potential for an upward breakout.

Gold is expected to remain in the Rs. 405,000 to Rs. 420,000 band this week. Investors are advised to watch out for international cues including upcoming U.S. CPI data and geopolitical developments that could increase volatility.

🔗 Stay updated with daily gold rates at: www.dailygold.pk