24K Gold has reached a new record at ₨ 388,100 per tola, demonstrating the sustained demand for the metal as both an investment vehicle and a safe-haven asset. This marks a significant gain from the previous days, showing the ongoing trend in precious metals for 2025.

22K Gold, widely used for jewelry, is also seeing a rise, now priced at ₨ 355,850 per tola. The increase is in line with global price movements, but local factors such as strong jewelry demand ahead of the wedding season are contributing to the rise in prices.

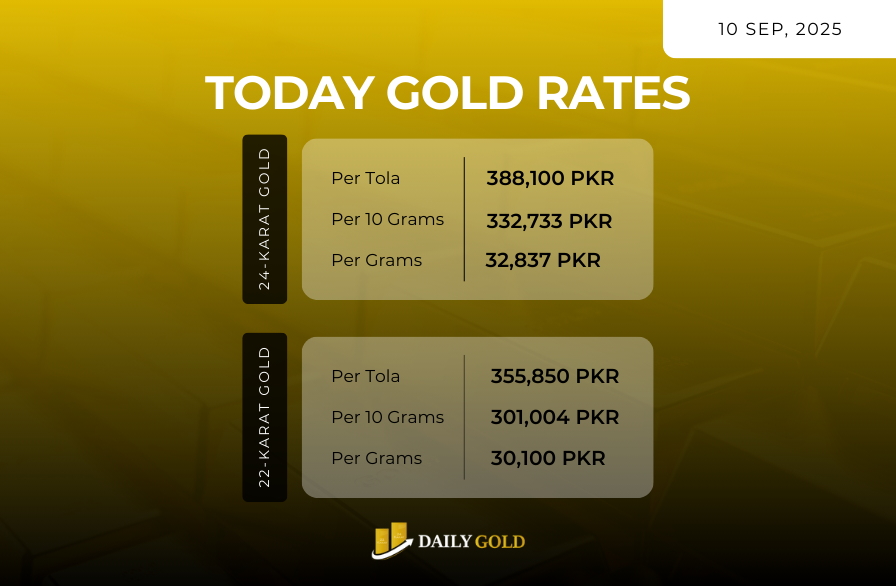

| Purity | Per Tola (PKR) | Per 10 Grams (PKR) | Per Gram (PKR) |

|---|

| 24K Gold | ₨ 388,100 | ₨ 332,733 | ₨ 32,837 |

| 22K Gold | ₨ 355,850 | ₨ 301,004 | ₨ 30,100 |

📈 Why Gold Prices Are Rising

- Global Economic Uncertainty: Geopolitical tensions, especially in Eastern Europe and the Middle East, have led to heightened uncertainty, encouraging investors to turn to gold as a safe-haven asset. Additionally, as global inflation continues to rise, investors are looking for assets that can preserve their wealth, and gold is historically seen as a hedge against inflation.

- Weakening U.S. Dollar: The U.S. dollar has continued to show weakness, which is boosting gold prices globally. When the dollar depreciates, it makes gold more attractive in other currencies, driving demand up. For countries like Pakistan, which imports a large amount of gold, this depreciation increases the price of gold locally.

- Inflation: With inflation rates at historically high levels in many economies, gold has become an attractive store of value. The Federal Reserve’s decision on interest rates, especially with the possibility of rate cuts, makes gold even more appealing, as the opportunity cost of holding gold (which does not yield interest) becomes less significant.

- Local Factors: In Pakistan, there is increased demand for both 24K and 22K gold due to the wedding season and gifting traditions. Gold jewelry remains highly popular, and the seasonal demand drives local market prices higher.

🧭 Gold’s Technical Analysis

Gold’s current price level is maintaining its bullish momentum, with the market holding above key technical levels. The 23.6% Fibonacci retracement for gold, around ₨ 370,000 per tola, has held strong as support, with the metal now trading well above this level. As long as gold remains above this level, the bullish trend remains intact.

- Support Levels: The price of gold is expected to find support at ₨ 370,000 per tola. This level has previously provided strong support, making it a key point to watch for any potential price corrections.

- Resistance Levels: The next major resistance level for gold is expected to be around ₨ 390,000 per tola. If gold breaks through this level, we could see prices move towards the ₨ 400,000 per tola mark.

🔮 Gold Price Forecast for 11 September 2025

- 24K Gold: Gold prices are expected to stay strong and could range between ₨ 388,000 – ₨ 390,000 per tola.

- 22K Gold: Similarly, 22K gold is expected to hold steady between ₨ 355,000 – ₨ 358,000 per tola.

Stay Updated with Daily Gold Pakistan.